Wynn Resorts fined $5.5M for illegal scheme to recruit high-rollers

Published in Business News

The Nevada Gaming Commission on Thursday fined Wynn Resorts Ltd. $5.5 million to settle a complaint, the third major fine against a Strip property for failed oversight of illegal gambling this year.

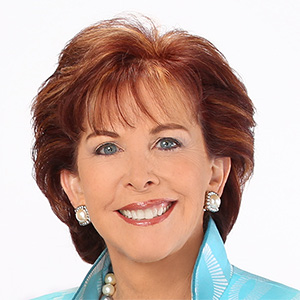

Commissioners voted 4-1 to approve a stipulation of settlement. Commissioner Rosa Solis-Rainey cast the lone vote against approval, believing the fine amount to be too low compared with recent disciplinary actions.

The complaint, filed by the Nevada Gaming Control Board last week is related to Wynn’s use of unlicensed money transmitting businesses in a scheme to recruit high-rollers.

The employees involved in the matter are no longer with the company, which issued a statement the day after the complaint was made public.

“We are pleased that we have resolved this matter with the Nevada Gaming Control Board, which is the same matter Wynn Las Vegas resolved with the U.S. Attorney’s office in September 2024,” the Friday statement said. “Wynn Resorts is committed to acting with the highest integrity and in full compliance with all laws and regulations governing our industry. The improper actions that are the subject of the settlement, which violated Wynn’s own compliance policies and procedures, were undertaken by individuals with whom we severed ties years ago. We accept responsibility for those actions and are now glad the matter will soon be fully resolved.”

Wynn forfeited $130.1 million in a non-prosecution agreement with the U.S. Attorney’s Office for the Southern District of California and the U.S. Department of Justice to end an investigation in September.

Wynn Resorts Board Chairman Phil Satre and key compliance officers addressed commissioners about the complaint.

Third disciplinary action

Wynn becomes the third company with a Strip presence to be fined millions of dollars by the commission for disciplinary reasons.

In the previous two months, the Gaming Commission fined MGM Resorts International $8.5 million in April and Resorts World Las Vegas $10.5 million in March in separate money-laundering cases.

The Wynn fine was tied for the fifth highest ever assessed by state gaming regulators. Nevada fines associated with Wynn since 2019 total $35.5 million, including a record $20 million assessed in 2019 involving the company’s failure to properly investigate assault allegations brought by female employees.

But Wynn representatives say the days when inappropriate response to compliance issues are long gone.

Since the incidents occurred as early as 2016 and former Chairman and CEO Steve Wynn left the company in 2018, Wynn has rebuilt its executive team with CEO Craig Billings, Chief Financial Officer Julie Cameron-Doe, General Counsel Jaqui Krum, Chief Operating Officer Brian Gullbrants and Chief Global Compliance Officer Omar Khoury, none of whom served in those positions during the conduct described in Control Board complaints.

The company also reconstituted a fully independent compliance committee comprised of three legal experts and two independent members of the Wynn board of directors, which also had a major overhaul.

The stipulation for settlement signed by the company says the company will continue to maintain its anti-money-laundering program, retain all records related to AML training and continue to maintain AML training materials for its independent agents.

Wynn’s internal audit team will be required to review, evaluate and report on the company’s compliance with its AML program with a report due in two years. Changes in the program must be reported to regulators.

The stipulation also requires Wynn to maintain an appropriate number of employees dedicated to AML compliance and provide reports on any changes within five business days.

Employees no longer with Wynn

Employees responsible for the illegal activity were fired by the company, which stated in the stipulation for settlement that “Wynn Las Vegas has worked hard over the last 20 years to develop and foster a strong culture of compliance, with the goal of achieving a ‘best-in-class’ compliance program.”

The company committed to a compliance-first mindset by frequently hosting formal and informal meetings with employees to reinforce its commitment to excellence.

“Unfortunately, a few former employees failed to adhere to the company’s clear compliance directives by allowing certain customers and independent agents to engage in the unlawful conduct as described in the complaint that clearly violated Wynn Las Vegas policies and procedures,” the company said in the stipulation. “Wynn Las Vegas immediately commenced an internal investigation and separated not only the employees involved in the misconduct, but also several employees who were aware of the misconduct and did not report it to Wynn Las Vegas, as required under the AML program.”

In September, federal authorities disciplined Wynn for regularly contracting with third-party independent agents acting as unlicensed money transmitting businesses to recruit foreign gamblers to the resort, according to the Justice Department. For the gamblers to repay debts to Wynn Las Vegas or have funds available to gamble there, the independent agents transferred the gamblers’ funds through companies, bank accounts and other third parties in Latin America and elsewhere, and ultimately into a Wynn-controlled bank account in the Southern District of California.

Funds deposited into the Wynn-controlled account were transferred into the Wynn cage account. According to federal attorneys, employees, with the knowledge of their supervisors, and working with the independent agents, eventually credited the Wynn account of each individual patron. The convoluted transactions enabled foreign gamblers at Wynn to evade foreign and U.S. laws governing monetary transfer and reporting.

The settlement with federal authorities was believed to be the largest ever for a casino.

What’s next?

What could happen next is unclear.

The Control Board won’t comment on pending investigations, but numerous reports have surfaced that agents are investigating illegal play by bookmakers at other Strip properties.

The case involving Resorts World isn’t resolved. The commission delayed action in January against Nicole Bowyer, the wife of one of the illegal bookmakers who played at Resorts World and was employed as an independent agent for the resort, earning commissions for recruiting high-roller play.

The commission sent a complaint on Bowyer back to the Control Board because it wanted a more severe penalty than a potential five-year suspension of her independent agent status. In their January meeting, commissioners discussed imposing a fine on Bowyer and possibly banning her for life.

___

©2025 Las Vegas Review-Journal. Visit reviewjournal.com.. Distributed by Tribune Content Agency, LLC.

Comments