Insurance costs edge higher for Florida homeowners and condo owners

Published in Business News

FORT LAUDERDALE, Florida — The upward rise in costs for homeowner insurance in Florida resumed during the first quarter of 2025, with average premium costs edging higher after dipping slightly in late 2024, new data released by the Florida Office of Insurance Regulation shows.

The average premium paid by owners of single-family homes in Florida increased by 0.3% — climbing from $3,646 to $3,658 — between the fourth quarter of 2024 and the first quarter of 2025, according to a South Florida Sun Sentinel comparison of figures released in the office’s quarterly Residential Market Share Report.

Condo unit owners saw their costs increase by 0.8%, from $1,714 to $1,729 during the period, the data shows.

Since the enactment of reforms in 2022 aimed at sharply reducing litigation costs for insurers, average premiums have increased 30.7% for homeowners and 28.8% for condo unit owners.

The first-quarter hikes followed cost decreases of less than 1% for homeowner policies and 1.7% for condo unit policies during the fourth quarter of 2024. That was the only quarter with cost decreases since the release of the reports began in 2022.

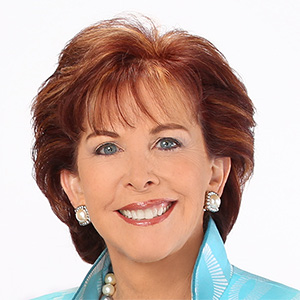

The office released the latest data without comment and Insurance Commissioner Michael Yaworsky did not respond to an email from the Sun Sentinel. An office spokeswoman said she did not believe that Yaworsky would be able to address the increases prior to this news article’s publication.

Mark Friedlander, senior director of media relations for the industry-funded Insurance Information Institute, attributed the increase to “higher replacement costs due to inflationary impacts of construction materials and labor.”

He also pointed out that the “slight increase is far below most other hurricane-prone coastal states, which are experiencing double-digit premium increases.”

The data showing the cost increases for Florida consumers followed the release of an analysis by insurance ratings firm AM Best noting improvements in the state’s insurance market.

In addition to achieving, in 2024, the market’s first collective underwriting profit in eight years, the AM Best report cited the emergence of 13 new private-market insurers, stabilizing premiums and reinsurance costs, and a sharp reduction in policies held by state-run Citizens Property Insurance Corp., the state’s so-called insurer of last resort.

The improvements were made possible, AM Best said, by tort reforms enacted in 2022 and 2023 by the Florida Legislature and governor to reduce runaway litigation costs that were driving losses within the industry.

During debate in the Legislature over the reforms, insurance insiders predicted that costs for consumers, then rising sharply, would stabilize or even be reduced after litigation that was underway had a few years to work its way through the courts.

Prior to the start of the 2025 legislative session, Yaworsky joined Gov. Ron DeSantis at a news conference touting the number of insurers that submitted requests for lower or unchanged rates.

Critics, however, said the reforms have gone too far, adding to insurer profits while leaving policyholders with less leverage over claims disputes. A bill was backed by plaintiffs attorneys that would have reinstated requirements for insurers that lose claims disputes to pay plaintiffs’ legal fees. It passed the House but was not advanced in the Senate.

Insurance premiums increased for 41 of 61 carriers with 1,000 or more policies, according to the analysis.

The Cincinnati Insurance Co. charged the largest premium increase — 45.7% — among the group of Florida-registered insurers. While its policy count decreased from 1,631 to 1,009, its average premium increased from $11,014 to $16,044.

Average risk covered by the Fairfield, Ohio-based company is $2.8 million.

Truck Insurance Exchange’s 2,390 policyholders saw the second-largest increase, 16.1%, as premiums swelled from $2,059 to $2,390.

Premium costs for 20 companies increased by less than 2% and customers of 17 companies saw their premiums decrease, on average, between 0.2% and 9.3%

Companies with lower premiums included Florida-based Edison, Florida Peninsula, Security First, Monarch National, American Integrity, ASI Preferred, Safe Harbor, Orange and Safeport. Costs for Citizens customers declined by 1.9%, from $3,348 to $3,283.

The Sun Sentinel’s calculations excluded two companies from the fourth and first quarters and a third company from the first quarter. Fourth-quarter data reported by two of the companies contained obvious glitches that would have skewed results. The third company did not report its data in the fourth quarter but resumed reporting in the first quarter. Including that company’s data in the analysis would have made the first-quarter increases appear artificially large.

Condo associations saw relief for the third straight quarter as premiums fell by 5.3% following decreases of 2.5% and 3.0%. Condo association premiums had increased by an average 103% between June 2022 and June 2024 amid concerns about tightening inspection and maintenance requirements.

©2025 South Florida Sun Sentinel. Visit at sun-sentinel.com. Distributed by Tribune Content Agency, LLC.

Comments