Senate Republicans set up potential clash with House on 'big, beautiful bill'

Published in Political News

WASHINGTON — Last week, the U.S. Senate released its version of the “big, beautiful bill” that would implement President Donald Trump’s campaign promises to cut taxes and reduce federal spending.

But tweaks to the bill made by Republican senators to match their priorities threaten the delicate balance that allowed the bill to pass narrowly in the House.

Senate Republicans have given themselves a July 4 deadline to pass their version of the bill. What stays in and what is amended could affect support not only in the Senate, where Republicans have a three-vote majority, but could also doom it when it heads back to the House for another vote.

Republicans also have a slim majority in that chamber, and Democrats are fully opposed to the package.

Here are some key differences between the House and Senate bills.

MEDICAID

The Senate bill would expand the Medicaid work requirement to apply to parents of teens. The House bill would not require any parents to meet work requirements in order to be eligible for Medicaid.

The Senate also goes further in restricting how states tax hospitals to help pay for the Medicaid program. The District of Columbia and 40 states that expanded Medicaid would see a reduction in how much they can tax providers. Georgia is not one of the states that expanded Medicaid.

The House bill freezes the provider tax at current levels for all states.

FOOD STAMPS

Compared to the House bill, the Senate text makes less-drastic changes to the Supplemental Nutrition Assistance Program, the program more commonly known as food stamps. Still, the Senate would also shift billions of dollars in program costs to states according to a formula that corresponds with the amount of billing mistakes and payment errors found when state programs are audited.

The Senate bill caps the state share of SNAP costs at 15%, compared to 25% in the House.

Georgia could be on the hook to find more than $800 million in state funding to keep SNAP at its current level if the House bill were to become law. That number would drop to around $500 million under the Senate plan.

FIREARMS

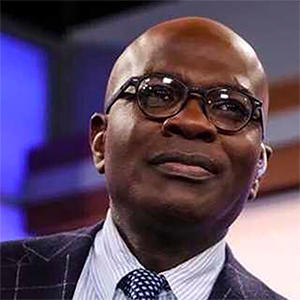

The House bill eliminated a $200 tax on the purchase of gun silencers and removed silencers from being tracked or regulated by the federal government, provisions that Georgia Rep. Andrew Clyde, R-Athens, fought for to get his vote.

The Senate bill includes that language and goes even further, expanding it to also apply to short-barrel rifles, shotguns and other weapons.

Clyde sees these changes as preserving the Second Amendment, calling the Senate bill a “Major 2A win.”

Democrats are likely to challenge the deregulation language during the process of asking the parliamentarian to ensure that all portions of the reconciliation bill are directly related to government spending. Democrats will argue that policy changes like this are not allowed in legislation where the filibuster cannot be applied.

CLEAN ENERGY

The Senate would give businesses more time to take advantage of clean energy tax credits passed during President Joe Biden’s administration.

The Senate still wants to phase out these credits, but not as quickly as what was passed in the House.

Businesses, including many that have expanded in red states like Georgia, have argued that projects providing jobs and boosting the economy would be derailed by the House’s quick timeline to end incentives that factored into these plans.

Georgia had more than 82,000 clean tech industry jobs as of late last year, according to one report. Many of those jobs were created after the passage of the Biden-era law that Republicans are now attempting to repeal.

TAXES

The Senate bill angered some House Republicans from Democratic states who wanted to increase how much of their state and local taxes people can deduct from their federal income tax filings. The Senate bill would maintain a $10,000 cap on the SALT deduction, compared to the House version that increased the cap to $40,000 for married couples with incomes up to $500,000.

The Senate bill also limits Trump’s proposals to eliminate taxes on tips and overtime, capping those deductions at a maximum of $25,000.

Finally, the Senate version permanently extends Trump’s 2017 tax cuts as he has requested, as well as business tax deductions for research and development expenses. The House version extends these measures for several years but does not make them permanent.

©2025 The Atlanta Journal-Constitution. Visit at ajc.com. Distributed by Tribune Content Agency, LLC.

Comments