DOJ's UnitedHealth investigation likely biggest Medicare Advantage fraud probe yet

Published in Business News

The federal government has upped its scrutiny of Medicare fraud in recent years, but no investigation appears bigger than its probe of UnitedHealth Group.

It’s the biggest because UnitedHealth is the nation’s largest provider of Medicare Advantage benefits, a privatized form of Medicare. And United’s Medicare business is the target of not only a civil inquiry, but an uncommon criminal investigation, too.

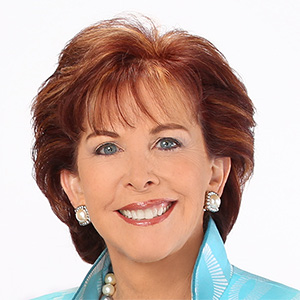

“The Department of Justice’s actions against (Medicare Advantage insurers) have been civil, focused on recovering money,” said David Lipschutz, co-director of the Connecticut-based Center for Medicare Advocacy. “I don’t recall any criminal cases.”

The Eden Prairie, Minnesota-based health care giant on Thursday acknowledged it’s cooperating with the U.S. Department of Justice (DOJ) in criminal and civil probes.

“The enhanced (civil and criminal) scrutiny of UnitedHealth raises the profile of this investigation,” said Eagan Kemp, a health care policy advocate for Public Citizen, a non-profit public interest group in Washington.

The taxpayer-funded Medicare Advantage program, administered by private insurers including UnitedHealthcare, has grown in popularity over the past 15 years, now drawing more members than traditional Medicare.

At the root of whistleblower lawsuits and investigations of Medicare Advantage programs are allegations that insurers like UnitedHealthcare have gamed the system to wrongly inflate the government payments they receive.

Insurers are accused of manipulating diagnosis codes to make patients look sicker. By doing so, they generate higher “risk scores” from Medicare administrators and thus gain more federal dollars — sometimes known as “upcoding.”

The Inspector General for the U.S. Department of Health and Human Services published a report in 2024 that found UnitedHealth stood out from its peers in using questionable diagnosis data to boost Medicare Advantage payments.

The company disputed the federal auditors’ findings in the report, which echoed conclusions from an earlier contested study.

“Right now, Medicare Advantage is where a lot of the concerns are — both on (Capitol) Hill and in recent administrations — over fraud and upcoding,” Kemp said.

In a major civil case, the federal government in 2023 won a $170 settlement with Cigna, the large Connecticut-based health insurer. It resolved allegations Cigna had violated federal law by submitting inaccurate and false diagnosis codes for Medicare Advantage enrollees.

As part of the settlement, Cigna inked a five year “corporate integrity agreement” with the U.S. Department of Health and Human Services. It requires Cigna to conduct annual risk assessments, while an independent reviewer will do its own audits of the company’s risk-adjustment data.

Other recent Medicare Advantage civil court settlements include:

Any fines, of course, hurt a company. But “given the massive windfall” from Medicare Advantage, Kemp said some companies seem to believe settlement payments “are part of the cost of doing business.”

“The real is risk is if Congress gets involved,” Kemp said, noting a growing bipartisan call for Medicare Advantage reform.

The government’s settlements with Cigna, Independent Health, Martin’s Point and Seoul Management all stem from whistleblower or “qui tam” lawsuits. Such cases are filed by employees, competitors or others familiar with the workings of an accused company.

The DOJ has the option of joining whistleblower suits as a plaintiff, but it does so only in a minority of cases.

It did so, however, in all four of those recent Medicare Advantage cases, and has also joined a 2011 whistleblower suit against UnitedHealth Group filed by a former UnitedHealth finance director, Benjamin Poehling.

Poehling’s suit claims UnitedHealth collected billions of dollars by increasing risk-adjustment payments in the Medicare Advantage program, while failing to fix instances where patients should have had fewer medical codes.

However, he and the DOJ were dealt a big blow in March when a court-appointed special master concluded the lawsuit should not go on.

The special master found the government lacked “any evidence” to support key elements of its case. UnitedHealth says it did nothing wrong.

Meanwhile, little is known about what the Justice Department is investigating at UnitedHealth in its new cases.

The DOJ probes into UnitedHealth were reported first by the Wall Street Journal, and the insurer’s acknowledgement was an about-face. After the Journal’s report this spring on the criminal investigation, UnitedHealth had called the newspaper’s reporting “deeply irresponsible.”

In a different case, the DOJ in 2020 filed a civil lawsuit against Indianapolis-based Anthem, alleging the insurer committed fraud by submitting inaccurate Medicare Advantage data to the government.

The DOJ claimed Anthem, now known as Elevance Health, netted more than $100 million Medicare overpayments. Anthem, which has denied the charges, sought to get the suit dismissed.

But a federal judge ruled in October 2022 that it would move forward. That case is still pending.

Any DOJ case against United resulting from the new investigations would also be prolonged.

“We think that any litigation that could result from the DOJ’s requests would be potentially lengthy and shaped by the outcome of the existing litigation and the Special Master’s report, making it challenging to handicap any real (financial) impact (on the company),” J.P Morgan analyst Lisa Gill said in a research note Friday.

©2025 The Minnesota Star Tribune. Visit at startribune.com. Distributed by Tribune Content Agency, LLC.

Comments